You are here

India’s National Hydrogen Mission and Prospects for Cooperation with GCC

Summary: National Hydrogen Mission aims to cut down carbon emissions and increase the use of renewable sources of energy while aligning India’s efforts with global best practices in technology, policy and regulation. The Government of India has allotted Rs 25 crore in the Union Budget 2021–22 for the research and development in hydrogen energy and intends to produce three-fourths of its hydrogen from renewable resources by 2050. Similarly, the GCC countries have invested heavily in hydrogen energy and are looking at it as the holy-grail to a cleaner future. This is an opportune time for India and the GCC countries to strengthen partnership in R&D, production, storage and transportation of hydrogen energy. India should look at enhancing hydrogen cooperation with GCC countries, especially the front runners, i.e., Saudi Arabia, the UAE and Oman.

Summary: National Hydrogen Mission aims to cut down carbon emissions and increase the use of renewable sources of energy while aligning India’s efforts with global best practices in technology, policy and regulation. The Government of India has allotted Rs 25 crore in the Union Budget 2021–22 for the research and development in hydrogen energy and intends to produce three-fourths of its hydrogen from renewable resources by 2050. Similarly, the GCC countries have invested heavily in hydrogen energy and are looking at it as the holy-grail to a cleaner future. This is an opportune time for India and the GCC countries to strengthen partnership in R&D, production, storage and transportation of hydrogen energy. India should look at enhancing hydrogen cooperation with GCC countries, especially the front runners, i.e., Saudi Arabia, the UAE and Oman.

On 15 August 2021, Prime Minister Narendra Modi announced the launch of National Hydrogen Mission (NHM) while commemorating the 75 years of independence with an aim to cut down carbon emissions and increase the use of renewable sources of energy. The broad objective of the mission is to scale up Green Hydrogen production and utilisation and to align India’s efforts with global best practices in technology, policy and regulation. Accordingly, the Government of India has allotted Rs 25 crore in the Union Budget 2021–22 for the research and development in hydrogen energy.1

The NHM, according to a draft paper prepared by the Ministry of New and Renewable Energy (MNRE), has identified pilot projects, infrastructure and supply chain, research and development, regulations and public outreach as broad activities for investment with a proposed financial outlay of Rs 800 crores for the next three years.2 It aims to leverage the country’s landmass and low solar and wind tariffs to produce low-cost green hydrogen and ammonia for export to Japan, South Korea and Europe. In this regard, there are immense possibilities for India to collaborate with the Gulf Cooperation Council (GCC) countries that have also invested significantly in developing hydrogen as a future source of energy. Geographical proximity and robust trade ties in conventional energy calls for proactive measures to collaborate with GCC countries especially Saudi Arabia, UAE and Oman for research and development pertaining to hydrogen energy.

Hydrogen Energy

Hydrogen is emerging as an important source of energy since it has zero carbon content and is a non-polluting source of energy in contrast to hydrocarbons that have net carbon content in the range of 75–85 per cent. Hydrogen energy is expected to reduce carbon emissions that are set to jump by 1.5 billion tons in 2021.3 It has the highest energy content by weight and lowest energy content by volume.4 As per International Renewable Energy Agency (IRENA), Hydrogen shall make up 6 per cent of total energy consumption by 2050.5 The Hydrogen Council Report, 2021 also mentions that, global investments on hydrogen will constitute around 1.4 per cent of the total global energy funding by 2030.6 In its 2019 technology report titled “The Future of Hydrogen”, International Energy Agency (IEA) has given seven-point recommendation encouraging establishment of a role for hydrogen in long-term energy strategies.7

Hydrogen energy is currently at a nascent stage of development, but has considerable potential for aiding the process of energy transition from hydrocarbons to renewables. Though it is the most abundantly available element on earth, commercially viable Hydrogen can be produced from hydrocarbons including natural gas, oil and coal through processes like steam methane reforming, partial oxidation and coal gasification; as well as from renewables like water, sunlight and wind through electrolysis and photolysis and other thermo-chemical processes. The current global demand for hydrogen is 70 million metric tons per year, more than 76 per cent of which is being produced from natural gas, 23 per cent comes from coal and the remaining is produced from electrolysis of water.8

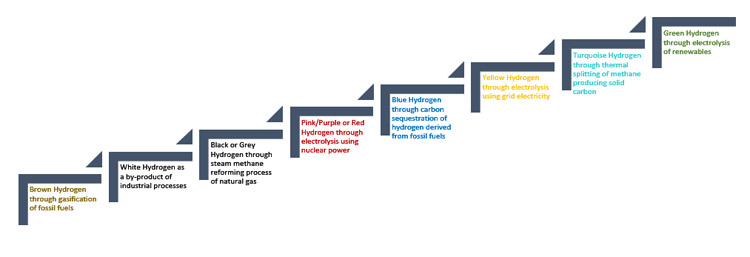

Hydrogen can be stored in cryo-compressed tanks in gaseous form apart from being kept in liquefied and solid state. Presently, Hydrogen is mostly used in industry sector including those dealing with oil refining, ammonia production, methanol production and steel production. It has huge potential in transportation sector as a direct replacement to fossil fuels. Shipping and aviation have limited low-carbon fuel options available and represent an opportunity for hydrogen-based fuels. Hydrogen has been colour-coded based on the source of production (Figure 1), and the emphasis is on the use of Green Hydrogen as it helps in reducing the emissions of greenhouse gases and increases the share of renewables in total energy consumption. Currently the production of green hydrogen is two or three times more expensive than blue hydrogen, but with advancement in science and technology, it is expected to become a cheap fuel in the future.

Source: Adapted from H2bulletin and energycentral

Hydrogen Energy in India

At present, bulk of the global energy consumption comes from hydrocarbons.9 Hydrogen is at an early stage of entering the energy sector in India. Government as well as non-government funding agencies are engaged in R&D projects pertaining to hydrogen production, storage, utilisation, power generation and for transport applications. As early as in 2003, National Hydrogen Energy Board was formed and in 2006 the Ministry of New and Renewable Energy laid out the National Hydrogen Energy Road Map identifying transport and power generation as two major green energy initiatives.10 India is participating in Mission Innovation Challenge for clean hydrogen and shares the objective to accelerate the development of a global hydrogen market by identifying and overcoming key technology barriers to the production, distribution, storage and use of hydrogen at gigawatt scale. By 2050 India intends to produce three-fourths of its hydrogen from renewable resources.11

R&D projects in India focus on improving the efficiency of water-splitting reaction, and finding newer materials, catalysts and electrodes to accelerate the reaction. Presently, more than 100 research groups are focusing on fuel cell technology. There are a number of foreign and Indian companies that are involved in hydrogen production, storage or delivery in India, including Praxair (USA), Linde (global-member of hydrogen council), Inox (Indo-US joint venture), Air Liquide (France), SAGIM (France), Air Products (USA), Fuel Cell Energy (USA), H2Scan (USA), ITM Power (UK), Heliocentris (Germany), Aditya Birla, Bhoruka Gases Ltd, Gujarat Alkalies and Chemicals Limited, Gujarat Heavy Chemicals Ltd, Air Science Technologies and Sukan Engineering Private Limited.

Hydrogen Energy and GCC

Rich in hydrocarbon resources, currently the GCC countries consume around 7 per cent of the grey hydrogen sourced from the natural gas. Qatar is the largest consumer of hydrogen in the region followed by Saudi Arabia, Kuwait, Oman, the UAE and Bahrain.12 UAE and Saudi Arabia, and more recently Oman, have embraced the concept of a hydrogen economy. They are keen to use it domestically as part of decarbonisation effort as well as intend to use it as an alternative export commodity. Besides, there are other motivating factors including energy security and economic diversification.

GCC countries are at the forefront of cost reductions in renewables and in shaping the energy transformation within as well as outside the region. According to an IRENA analysis, the accelerated deployment of renewable energy in the GCC region can reduce emissions of CO2 by 136 million tons. GCC countries are looking at renewable energy as a job generating sector13 for their young demography that is grappling with unemployment and the spillover effect might also impact the expatriate population positively.14 Further, realising their renewable energy targets would lead to an estimated reduction of 17 per cent and 12 per cent in power sector water withdrawal and consumption, respectively.15

Apart from that, there are facilitating factors that make it convenient for the GCC countries to invest in renewable energy. These countries have the potential to become hydrogen producers as well as exporters as they have existing industrial capacity and required capital to invest in the initial infrastructure. Second, GCC has abundance of inexpensive land and water along with solar and wind resources that can help in production of Green Hydrogen. Third, the countries are situated in geographical proximity to the emerging and future markets for cleaner fuel. Lastly, the GCC countries can easily be producers of Blue Hydrogen due to availability of hydrocarbons and the carbon capture, utilisation and storage (CCUS) capacity.

Targets and Projects

GCC countries have set a number of targets for achieving self-sufficiency and export capacity in renewable energy including hydrogen. Saudi Arabia has set eyes on becoming the world’s largest supplier of hydrogen worth US$ 700 billion by 2050 by investing in the Helios Green Fuels plant in the NEOM city.16 The UAE aims to meet 44 per cent of energy needs through clean energy as per Energy Strategy 205017 and Masdar aims to emerge as hub of hydrogen production. Oman is targeting to meet 40 per cent of its energy needs through renewables as mandated by Vision 2040.18 The Ministry of Energy and Minerals is establishing a National Hydrogen Alliance (branded as Hy-Fly) to support and facilitate the production, transport and utilisation of clean hydrogen for domestic use and export. Oman intends to build one of the largest Green Hydrogen plants in the world in Al Wusta Governorate. Also, Kuwait aims to generate 15 per cent of its electricity from renewable sources by 203019 and Kuwait National Petroleum Company’s Clean Fuels Project to upgrade downstream operations includes construction of a new hydrogen plant at the Mina Abdullah Refinery. Bahrain is to meet 10 per cent electricity generation through renewables as per Vision 2030.20

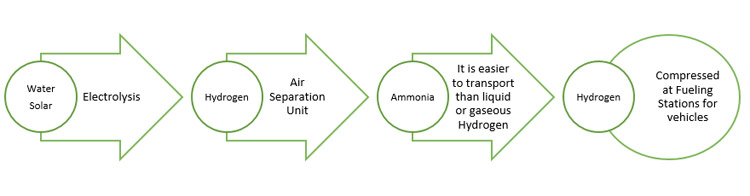

GCC countries are hosting a number of ambitious hydrogen energy projects. In July 2020, Saudi investor ACWA Power signed a US$ 5 billion agreement with an American company Air Products and Chemicals to develop the Helios plant in NEOM City that will be powered by the solar and wind energy. The plant will produce Green Hydrogen through electrolysis that will be converted into Ammonia using an air separation unit later to be transported through sea lanes and road to its destination. After reaching the final refueling stations, ammonia will be converted into hydrogen and compressed to be used in hydrogen vehicles (Figure 2).21

Figure 2: Hydrogen Production to Utility Process in Helios Plant in NEOM City

Source: Adapted from “Hydrogen in the GCC: A Report for the Regional Business Development Team Gulf Region”.

A number of other projects are ongoing in GCC in collaboration with the US, France, Japan and Belgium. Air Products Qudra, a Saudi–US joint venture is to produce Grey Hydrogen at the Jubail Industrial City. Air Liquide Arabia, a Saudi–French joint venture is to supply hydrogen to the YASREF refinery, SAMREF refinery and three industrial complexes within Yanbu. Abu Dhabi Department of Energy and Abu Dhabi Future Energy Co. have signed MoUs with Etihad Airways, Lufthansa Group, Siemens Energy and Marubeni Corporation of Japan to build a demonstration-scale green hydrogen plant at Masdar City. DEME Concessions of Belgium and the Oman’s national oil company OQ is to build a 250MW–500MW electrolyzer facility through the HYPORT Duqm Green Hydrogen Project. Oman’s SOHAR Port and Freezone is to host a large-scale green hydrogen generation hub powered by solar power plants.

India–GCC Cooperation

India and GCC countries share robust energy cooperation. In 2017–18 India imported nearly 53 per cent of its energy from the Persian Gulf, and UAE and Saudi Arabia were third and fourth largest trading partners of India.22 India and the GCC are natural energy partners and have huge potential for extending cooperation in cleaner fuels like hydrogen. India has signed MoUs on renewable energy with most of the GCC countries. India’s largest pure-play solar platform Acme Solar Holdings Ltd plans to invest US$ 2.5 billion to manufacture green ammonia and green hydrogen in Duqm and signed an MoU with the Oman Company for the Development of the Special Economic Zone. The manufacturing facility will supply green ammonia to Europe, America and Asia region and will produce 2,200 metric tonnes (mt) of green ammonia per day.23

India is looking at developing Hydrogen collaboration with Bahrain and even invited Bahrain to participate in the Hydrogen Roundtable when Bahraini foreign minister Dr Abdullatif bin Rashid Al-Zayani visited New Delhi in April 2021. The two countries agreed to engage more in renewable energy capacity-building and focus on cooperation between their governments as well as the private sector, particularly in the field of solar, wind and clean hydrogen. In 2019, India signed an agreement with Saudi Arabia about cooperation in renewable energy including hydrogen. The two countries are collaboratively exploring Hydrogen Energy as a future source of energy. Saudi companies like Alfanar and Aljomaih that have invested in India’s wind and solar energy projects may be roped in for collaboration on production of Green Hydrogen.

Prospects for Collaboration

The political will to promote hydrogen energy and collaborate with regional and international actors exists on both sides. Prime Minister Modi announced NHM on Independence Day and said that Green Hydrogen will give India a quantum jump in achieving its renewable energy targets and help in becoming Aatmanirbhar (self-reliant) in energy. In 2018, he had invited GCC business leaders to invest in India’s energy sector.24 Former Petroleum Minister Dharmendra Pradhan had emphasised that India is committed to engaging with partners for ushering-in the hydrogen economy.25 Similarly GCC leaders too have stated the importance of clean fuel and their willingness to collaborate on the hydrogen energy. Prince Abdulaziz bin Salman, Saudi Arabia’s Minister of Energy, said that the Kingdom is pioneering green and blue hydrogen and is collaborating with many countries.26

Major prospects of hydrogen collaboration between India and GCC countries are in terms of investment and technology sharing. One of the major challenges faced by GCC countries in production of hydrogen fuel is the incompatibility of electrolyzers with salt water. Sea water needs to be desalinised before it becomes feasible for electrolysis. There is a potential for collaboration between India and these countries on this issue. A number of Indian research groups are working on hydrogen generation from sea water. For instance, Central Electrochemical Research Institute, Karaikudi is conducting research on design of electrodes and electrolytes for hydrogen generation using sea water and Centre for Fuel Cell Technology at the International Advanced Research Centre for Powder Metallurgy and New Materials, Chennai is conducting research on sea water electrolysis.

Similarly, with growing consumption pattern, GCC countries produce ample solid waste that can be used to produce hydrogen. Indian Institute of Science (IISc), Bangalore, National Institute of Technology (NIT), Rourkela, Indian Institute of Chemical Technology (IICT), Hyderabad and NIT, Raipur are conducting researches on production of Bio Hydrogen from waste and open avenues for cooperation between New Delhi and GCC countries especially the UAE that produces highest daily per capita municipal solid waste in the world. The GCC countries especially Saudi Arabia and UAE have invested in enhancing carbon capture, utilisation and storage and there is potential for Indian institutes working on the same to collaborate in terms of knowledge sharing. Similarly, these countries have made considerable investments in Fuel Cell Electric Vehicles and Indian research groups can benefit from the collaborations.

Introducing hydrogen to import basket would help in reduction of carbon footprint as well as reduce India’s import bill till the time we become self-reliant. GCC countries are focusing on exporting hydrogen to European countries and Southeast Asian countries; therefore the need of the hour is to act fast in order to reap the benefits of cost competitiveness. Collaboration with the GCC countries will accelerate India’s hydrogen mission and reduce the time for New Delhi to export hydrogen. GCC countries are India’s age-old energy partners and have experience in energy production and distribution. Since this is an emerging field, India can ask for partnership on equal terms. India can aim to benefit from the abundant potential of GCC, and the GCC countries can depend on its long-time reliable partner while benefitting from R&D and skilled human resource. The Middle East Green Initiative 2021 to be held in October 2021 in Riyadh can be a platform to further India’s hydrogen cooperation with the region.

Conclusion

India’s National Hydrogen Mission is a futuristic vision that can help the country not only cut down its carbon emissions but also diversify its energy basket and reduce external reliance. The GCC countries have a shared vision of energy transition and have invested heavily to ramp up their capacity in renewables. Hydrogen energy is at a nascent stage of development but has significant potential for realising the energy transition in India. Therefore, this is an opportune time for India and the GCC countries to strengthen partnership in R&D, production, storage and transportation of hydrogen energy. India should look at enhancing hydrogen cooperation with GCC countries, especially Saudi Arabia, the UAE and Oman that are at the forefront of hydrogen energy production and consumption. India and the GCC share convergence of ideas and interests along with the political will to collaborate; the need is to provide impetus to the public and private partnerships in the hydrogen energy sector that has a strong potential for growth in future.

Views expressed are of the author and do not necessarily reflect the views of the Manohar Parrikar IDSA or of the Government of India.

- 1. Shine Jacob, “National Hydrogen Mission: All You Need to Know about India's Plans and Potential”, Money Control, 10 February 2021.

- 2. “Centre Readies National Hydrogen Mission, 800 Crore Outlay Planned”, Asian News, 15 April 2021.

- 3. “Global Carbon dioxide Emissions are Set for their Second-biggest Increase in History”, International Energy Agency Press Release, 20 April 2021.

- 4. Energy stored in 1 kilogram of hydrogen gas is about the same as the energy in 2.8 kilograms of gasoline.

- 5. Global Energy Transformation: A Roadmap to 2050, April 2019 Edition, International Renewable Energy Agency.

- 6. “Hydrogen Insights: A Perspective on Hydrogen Investment, Market Development and Cost Competitiveness”, Hydrogen Council, McKinsey and Company, Report, February 2021.

- 7. The recommendations focus on stimulation of commercial demand for clean hydrogen, addressing investment risks of first-movers, supporting research and development to bring down costs, elimination of unnecessary regulatory barriers and harmonised standards and engagement at international level. “The Future of Hydrogen: Seizing Today’s Opportunities”, International Energy Agency Technology Report for G20 Japan, June 2019.

- 8. Martin Lambert, “Hydrogen and Decarbonisation of Gas: False Dawn or Silver Bullet?”, Energy Insight 66, The Oxford Institute for Energy Studies, March 2020.

- 9. More than 75 per cent of India’s energy supply comes from the hydrocarbons while less than 25 per cent comes from renewables. The energy consumption is dominated by industry and residential sector while transport and services constitute only around 29 per cent of total energy consumption. In 2007–08, hydrogen was mainly produced as well as consumed by the fertiliser industry, petroleum refineries and chlor-alkali industry in India.

- 10. “National Hydrogen Energy Road Map: Pathway for Transition to Hydrogen Energy for India”, National Hydrogen Energy Board, Ministry of New and Renewable Energy, Government of India, 2006.

- 11. “PM Announces Hydrogen Mission, Self-Reliance in Energy by 2047”, The Economic Times, 15 August 2021.

- 12. “Hydrogen in the GCC: A Report for the Regional Business Development Team Gulf Region”, Commissioned by the Netherlands Enterprise Agency, Department of the Dutch Ministry of Economic Affairs and Climate Policy, Ministry of Foreign Affairs, Qamar Energy, November 2020.

- 13. As per IRENA, the sector can create more than 2,07,000 jobs in the region by 2030. “Five Reasons Why Countries in the Gulf are Turning to Renewables”, International Renewable Energy Agency, 20 October 2019.

- 14. Lakshmi Priya, “Labour Sector Reforms in the GCC and Challenges for Indian Expatriates”, Issue Brief, Manohar Parrikar Institute for Defence Studies and Analyses, 27 November 2020.

- 15. “Five Reasons Why Countries in the Gulf are Turning to Renewables”, International Renewable Energy Agency, 20 October 2019.

- 16. “Saudi Arabia Pushes Ahead with Plan to be World’s Top ‘Green Hydrogen’ Producer”, Arab News, 7 March 2021.

- 17. “United Arab Emirates—Country Commercial Guide”, International Trade Administration.

- 18. “Oman Vision 2040 Document: Moving Forward with Confidence”, Oman Chamber of Commerce and Industry, Sultanate of Oman.

- 19. “Kuwait Voluntary National Review 2019”, Report on the Implementation of the 2030 Agenda to the UN High-Level Political Forum on Sustainable Development.

- 20. “The Kingdom of Bahrain’s First Voluntary National Review (2018) on the Implementation of the 2030 Agenda for Sustainable Development and the Sustainable Development Goals”, The Kingdom of Bahrain, 10 July 2018.

- 21. Peter Terium, Energy Managing Director NEOM said that the Helios plant will produce 650 tons of hydrogen per day. Verity Ratcliffe, “Saudi Arabia Takes Steps to Lead the $700B Global Hydrogen Market”, World Oil, 3 July 2021.

- 22. Adapted by the author from the website of Department of Commerce, Export Import Data Bank, Ministry of Commerce and Industry, Government of India.

- 23. “ACME Group Inks Land Agreement to set up Large Scale Green Ammonia and Green Hydrogen Facility at SEZ in Duqm, Oman”, ACME Group, Press Release, 23 August 2021.

- 24. “Come to India for Business: PM Modi's Pitch before Gulf Council Captains”, Business Standard, 11 February 2018.

- 25. “India is Looking Towards Kick-starting the Hydrogen Ecosystem Development, Says Shri Dharmendra Pradhan”, Press Information Bureau, Ministry of Petroleum and Natural Gas, Government of India, 15 April 2021.

- 26. It intends to fulfil 50 per cent of power needs by renewables. Argaam, “Saudi Arabia to Pioneer Producers of Green, Blue Hydrogen: Energy Minister”, Arab News, 27 January 2021. H.E. Dr. Sultan Al Jaber, Minister of Industry and Advanced Technology and Special Envoy for Climate Change, United Arab Emirates said that UAE is exploring the viability of markets in Asia and in Europe and will emerge as a major supplier of blue hydrogen worldwide. Salim Al-Aufi, Undersecretary, Ministry of Energy and Minerals, Oman said that Oman is established, world-connected and reliable energy producer and exporter, and is well placed due to its climate, geo-strategic position and its know-how to drive the shift towards renewables and green hydrogen, “Oman Establishes Hydrogen Alliance to Drive National Hydrogen Economy”, Oil Review-Middle East, 12 August 2021. Suhail bin Mohammed Al Mazrouei, Minister of Energy and Infrastructure said that the UAE National Energy Strategy 2050 supports the production of clean hydrogen, as the country intends to achieve 50 per cent of clean energy by 2050, “UAE Ministry of Energy and Infrastructure to Support Abu Dhabi Hydrogen Alliance”, Utilities, 3 March 2021.