- About us

- ABOUT MP-IDSA

- VISION STATEMENT

- CONFERENCE FACILITY

- EXECUTIVE COUNCIL

- Memorandum of Association: Rules and Regulations

- MP-IDSA NEWS

- DIRECTOR GENERAL

- INTERNATIONAL INTERACTIONS

- Fellowship rules

- VISITING FELLOWSHIPS PROGRAMME

- K. SUBRAHMANYAM AWARD

- Deputy Director General

- INTERNSHIP PROGRAMME

- CONTACT US

- Former Presidents

- HUMAN RESOURCES

- JOBS

- Former Directors

- Prevention of Sexual Harassment

- CENTRES

- Events

- Library

- Publications

- Membership

IDSA COMMENT

Union Budget 2016-17: Deciphering the Defence Budget

More from the author

It probably is the first time that there was no mention of ‘Defence’ in the Finance Minister’s February 29 budget speech. To make the task of the strategic community tougher, the Demands for Grants of Ministry of Defence have been rationalised in Budget 2016-17 for “a clear and consolidated depiction of defence expenditures.” It was stated that “Two fold action has been taken in this regard- reducing the number of Demands for Grants and shifting of certain provisions on non-core activities to Defence (Civil) Demand.” A glitch in the Ministry of Finance (MoF) website has further added to the woe of the defence analysts as the Expenditure Budget Volume II does not open beyond sheet 1. Since it is arranged in an alphabetical order and the section on ‘Defence’ comes beyond sheet 1, the details about the defence budget are not accessible.

Table 1: Comparison of the Allocations as per the Old and New Demand Nos

Source: Union Budget 2016-17, Ministry of Finance, Government of India

The actual revenue expenditure in 2014-15 (demand nos 23 to 27) was Rs.137359.41 crore. The Budget Estimates (BE) for 2015-16 was at Rs.152139 crore, which is estimated to come down to Rs. 143236 crore in the Revised Estimates (RE) 2015-16. This represents an increase of 04.28 per cent over the last year’s actual expenditure. Given that the impact of increase in Pay & Allowances (annual increment of three per cent in basic pay and over 10 per cent increase in DA) would be substantially higher than this, the actual expenditure on stores, transportation, and revenue works and other miscellaneous charges has been lesser than the last year. A thorough introspection is thus needed since the allocated BE (RE is 94.18 per cent of BE) could not be fully utilised in the face of appetite for funds to augment the serviceability level of the platforms and equipment.

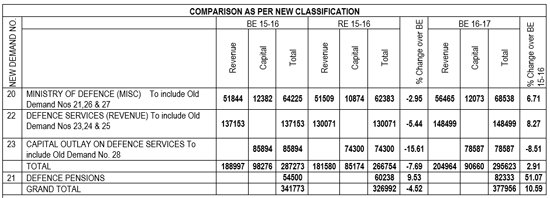

Table 2: Comparative Allocations as per the New Demand Nos

Click on table to enlarge

Source: Union Budget 2016-17, Ministry of Finance, Government of India

For the third consecutive financial year starting from 2013-14, the funds allocated under capital budget have not been fully utilised resulting in withdrawal at RE stage. The capital budget has two components. The first component is modernisation of the three services. The second includes land, capital works, the Defence Research and Development Organisation (DRDO), ordnance factories, etc.

Modernisation budget as a first charge caters for ‘Committed Liabilities’, i.e., milestone-related stage payment due in respect of contracts signed in the past; only the residual amount is available for making the first stage payment due on signing of contracts. A major portion of the the ‘Modernisation’ budget represents committed liabilties. Underutilsation of the major part, which represents ‘committed liabilties’, shows that the deliveries/stage payment milestones were not achieved. Project management is primarily the reponsibilty of Service HQs.

Finance Minister in his budget speech had stated that, “Members of this august House would have noted that we have been both transparent and quick in making defence equipment related purchase decisions, thus keeping our defence forces ready for any eventuality.” The underutilisation of funds also suggests that the meagre funds available in the modernisation budget after catering for committed liabilities also have not been fully utilised. Regular press reports post the Defence Acquisition Council (DAC) meetings have conveyed a host of acquisition proposals. The delay therefore is in the actions post this milestone. The issuing of Request for Proposal (RFP), opening bids, contract negotiations, and clearance before the Cabinet Committee on Security (CCS) approval are primarily carried out at the level of the defence and the finance ministry.

In recent years, the parliament standing committee reports have been focussing on projected fund requirements and budget allocations and on recommending additional allocation of funds. This year the committee needs to focus on the recurring underutilisation of BE under the capital budget and the underutilisation of revenue budget in the current financial year.

The writing on the wall is thus clear. According to the Medium Term Fiscal Policy Statement presented by the Finance Minister, “During the projection period of 2017-18 and 2018-19 it (revenue budget) is estimated to increase by 10 per cent over previous years. Total Defence expenditure including the Capital component is estimated at about 1.6 percent of GDP in 2017-18 and 2018-19.” Certainly, this would call for better expenditure management.

Views expressed are of the author and do not necessarily reflect the views of the IDSA or of the Government of India.

Related Publications