You are here

Defence Agenda for Modi Government 2.0

With the Modi Government returning to power, expectations of deeper and far-reaching reforms are high across various ministries and departments. The Ministry of Defence (MoD), which has already undertaken a plethora of reforms during the last five years, is expected to walk along the reform path and build on previous initiatives to further strengthen defence preparedness and build a credible defence industrial base. This Policy Brief outlines 27 reform measures in four broad areas – planning, budget, procurement and Make in India – for the new government’s consideration

With the Modi Government returning to power, expectations of deeper and far-reaching reforms are high across various ministries and departments. The Ministry of Defence (MoD), which has already undertaken a plethora of reforms during the last five years, is expected to walk along the reform path and build on previous initiatives to further strengthen defence preparedness and build a credible defence industrial base. This Policy Brief outlines 27 reform measures in four broad areas – planning, budget, procurement and Make in India – for the new government’s consideration

Defence Planning

In one of the boldest defence reforms in recent history, the first Modi Government had set up in April 2018 the Defence Planning Committee (DPC) under the chairmanship of the National Security Advisor (NSA). The NSA also replaced the Cabinet Secretary as the chairman of the Strategic Policy Group (SPG), one of the three-tier structures of the Prime Minister-led National Security Council (NSC). The purpose of the powerful DPC is to facilitate comprehensive and integrated defence planning, which has been a grey area in the MoD’s planning mechanism since it was put in place in the aftermath of the 1962 war. With the mandate, inter alia, to articulate a national security strategy, develop a holistic defence plan, keeping in view the critical requirements of the armed forces as well as resource constraints, and prepare a comprehensive R&D and manufacturing plan, the DPC’s role assumes critical importance in bridging the historical shortcomings. In view of its mandate, the DPC may like to bring out the following:

- A National Security Strategy articulating the key security challenges and objectives.

- A truly prioritised and realistic 15-year Long-Term Integrated Perspective Plan (LTIPP) and five-year and Services Capital Acquisition Plan (SCAP), taking into account both inter- and intra-service priorities, to focus on the capability development of the armed forces and meet the requirements of the modern warfare in its various forms.

- A roadmap for defence R&D and manufacturing to support Make in India and achieve self-reliance in defence procurement.

Defence Budget

With a budget of Rs 4,31,011 crore in the Interim Budget 2019-20, MoD accounts for 15.5 per cent of total central government expenditure (CGE). However, a very large portion of this budget is earmarked for manpower costs (Pay and Allowances, and Pensions), which has also witnessed a hefty rise after the implementation of the recommendations of the Seventh Central Pay Commission (CPC) and the One Rank One Pension (OROP) scheme. As a result, the capital procurement budget, which is critical for defence modernisation, has seen a marked fall in its share in the budget. In fact, spending on modernisation has declined from 26 per cent of the MoD’s expenditure in 2011-12 to 18 per cent in 2018-19 (see Table)

| Year | MoD’s Total Expenditure (Rs in Crore) | P&A and Pension (Rs in Crore) | P&A and Pension as % of MoD’s Total Expenditure | Capital Procurement (Rs in Crore) | Capital Procurement as % of MoD’s Total Expenditure |

|---|---|---|---|---|---|

| 2011-12 | 213673 | 92971 | 44 | 56282 | 26 |

| 2012-13 | 230642 | 106366 | 46 | 58769 | 25 |

| 2013-14 | 254133 | 114725 | 45 | 66850 | 26 |

| 2014-15 | 309251 | 138480 | 45 | 66152 | 21 |

| 2015-16 | 293920 | 143089 | 49 | 62236 | 21 |

| 2016-17 | 351550 | 185084 | 53 | 69280 | 20 |

| 2017-18 (RE) | 374004 | 204874 | 55 | 69401 | 19 |

| 2018-19 (BE) | 404365 | 224522 | 56 | 74224 | 18 |

Note: RE and BE are revised estimate and budget estimate, respectively.

Source: Author’s database

To provide greater momentum to the modernisation of the armed forces, there is a need to enhance defence spending. While doing so, there is an even greater need to generate resources by optimally using existing defence assets and rationalising the expenses of the MoD. The MoD, being the largest landholder in the government, sits on vast tracts of land measuring 1.73 million acres. A large portion of this land is unused or under-used. Given that much of the land is in prime areas, its judicious commercial exploitation, while keeping security concerns in view, would generate resources, which, in turn, could be channelled for modernisation. For optimisation of resources, MoD has already started implementing some of the recommendations of the Committee of Experts (CoE) it had set up under the chairmanship of Lt. Gen. (Retd.) D.B. Shekatkar with the mandate of suggesting measures to “enhance combat capability and rebalance defence expenditure”. The implementation of the pending reforms measures suggested by the CoE may be expedited to achieve the intended objectives.

In particular, the government may like to:

- Progressively increase the MoD’s budget from the present proportion of 2.1 per cent of GDP to at least 2.5 per cent.

- Rationalise manpower by reviewing the existing period of colour service so as to contain the pay and allowances portion of the defence budget.

- Explore the possibility of implementing the National Pension System (NPS) or a suitable variant to ensure that defence pensionary liability does not become unsustainable. Any new system adopted must take care of the unique nature of tenure and work environment of armed forces personnel.

- Expedite the process of putting all industrial establishments, including Base Repair Depots (BRD), Army Base Workshops (ABW) and Naval Dockyards under the Public Private Partnership (PPP) model.

- Explore the option of generating revenues by putting to commercial use the unused and underused defence land.

Defence Acquisition

The present Defence Procurement Management System and its structures, consisting of a number of hierarchical organisations – Defence Acquisition Council, Defence Procurement Board and Acquisition Wing, among others – and the Defence Procurement Procedures (DPP), have come a long way since their creation in 2001. The established structures and procedures have streamlined many aspects of acquisition through the periodic revision of the DPP. The organisational structure has, however, remained largely unchanged, and so has the way defence procurement is undertaken as well as the professional competence of those undertaking it.

This unreformed organisational structure has come in the way of efficiency and efficacy of procurement, as observed repeatedly by the Comptroller and Auditor General of India (CAG) in various audit reports. In its eye-opening performance audit report of 2019, which deals with 11 capital acquisition projects of the Indian Air Force (IAF), the CAG has unambiguously pointed out that the existing organisation has “resulted in diffused accountability” as it involves numerous agencies that are accountable to different administrative heads. Elaborating upon this complex chain of agencies involved, the CAG notes that, on an average, a high value procurement proposal has to pass through 80 members across eight different committees before being sent to the Cabinet Committee on Security. Such a cumbersome committee system with multiple decision points is a perfect recipe for inefficiency and delays

The de-centralised structure has also resulted in two crucial tasks of acquisition – formulation of qualitative requirement (QR) and technical evaluation of equipment - being performed without full regard to the spirit of DPP provisions, leading to complications in the latter stages of procurement. The above mentioned report of the CAG notes that the QRs, instead of being expressed in broad operational and functional terms, continue to be expressed “in terms of detailed technical specifications, often asking for specific design or technology.” Providing some crucial evidence in this regard, the report notes that in the case of the Medium Multi Role Combat Aircraft (MMRCA) and Attack Helicopters, the QRs of the IAF contained 660 and 166 parameters, respectively! This, says the CAG, “created bottlenecks during technical evaluation”, as “none of the vendors could fully meet” all the parameters. In fact, the supreme auditor has noted that, in 90 per cent of cases, none of the bids submitted by vendors could meet all the IAF’s QRs. Furthermore, the auditor also points out that, at times, the QR parameters are “vendors driven”, besides being unrealistic as they could not be met by even some of the biggest defence companies in the world. Such a narrow approach to QR formulation, which is key to determine quality, price and competition, is bound to complicate procurement and derail acquisition.

In a similar vein, the auditor has also pointed out the lack of objectivity and fair play in technical evaluation, citing instances where “equity was not maintained while evaluating the products of different vendors.”

In addition to shortcomings in the formulation of QRs and evaluation process, the acquisition machinery also suffers from lack of professional expertise to undertake the assigned tasks. This is particularly exemplified by the estimation of benchmark prices for assessing the reasonability of bid price. In the IAF acquisition report, the CAG notes that in 10 projects for which the MoD undertook efforts to estimate the benchmark price, the said price was significantly higher or lower than the bid price in eight cases. In one case, the benchmark price was a whopping 61 per cent lower than the bid price! Such price estimation, obviously, serves very little purpose other than delaying an already complex and time-consuming negotiation process

In view of the above shortcomings in the acquisition system, the MoD may like to:

- Explore the possibility of setting up a separate, integrated Department of Defence Acquisition (DDA) by centralising all acquisition related functions including those of QR formulation and trial evaluation, under one administrative head. The DDA may be headed by a dedicated Secretary level official to provide the required authority and importance to the organisation.

- Set up a dedicated trial command and an integrated QR cell under the authority of the DDA to perform the required task objectively and professionally.

- Establish a robust costing cell within MoD to assess the reasonability of price bids of vendors and support acquisition decision making.

- Take steps to professionalise the acquisition staff by providing suitable training on acquisition matters.

Make in India in Defence

Under the Make in India initiative, the government has already taken a large number of initiatives to promote indigenous defence manufacturing. These include a streamlined industrial licensing process; a hike in the foreign direct investment (FDI) cap from 26 to 100 per cent; a level-playing field for the private sector vis-à-vis public sector entities in payment and tax matters; an export promotion measure that includes a standard operating procedure (SOP) for giving time- and procedure-bound export authorisation to industry; an SOP for the use of MoD-owned trial/testing facilities by the private sector; outsourcing and vendor development guidelines for DPSUs and OFB to develop an indigenous supply chain; a scheme for self-certification of defence items by the industry to enable it to own responsibility for their production; a policy for indigenisation of parts and components for import substitution; and a simplified and streamlined DPP that includes a new chapter on strategic partnership (SP) guidelines to enable the private sector to undertake big-ticket defence manufacturing, and a brand new procurement category to enable domestic industry to focus on indigenous design and higher level of indigenisation.

Besides, the MoD has also announced an ambitious defence production policy that aims at arms production and export turnover of Rs 1,70,000 crore and Rs 35,000 crore, respectively, by 2025; launched two defence industrial corridors with an initial investment of over Rs 6,800 crore; identified a number items in which local suppliers would enjoy purchase preference; and announced a number of initiatives to support start-ups and innovation. These initiatives have begun to show results as can be seen in the continuous increase in defence production, which reached nearly Rs 64,500 crore in 2017-18 including about 6,000 crore worth of production by the private sector.

To build on the initiatives already taken and to further strengthen India’ defence manufacturing base, the MoD may consider the following additional measures

- Adopt ‘Buy India’ Principle in Defence Production Policy

- Corporatise the Ordnance Factory Board (OFB)

- Undertake Time-bound Strategic Disinvestment of BEML

- List the Unlisted DPSUs in Stock Exchange

- Consolidate four Defence Shipyards into one or two large Corporations

- Augment R&D Spending of DPSUs/OFB

- Implement SP Guideline in a Time-bound Manner

- Execute Orders meant for Private Sector in a Time Bound Manner

- Set up an Indian Institute of Defence Science and Technology (IIDST) on the line of Indian Institute of Space Science and Technology (IIST)

- Monitor DRDO Projects

- Leverage the Offset Policy to Obtain Technology and High-Value Manufacturing

- Reduce Indirect Arms Import

- Boost Exports Further

- Provide Deemed Export Status to Indian industry under the Buy (Global) Category of Procurement

- Provide Infrastructure Status to Defence Industry

Defence industry is a strategic industry, and its development is in the national security interest. To nurture this vital industry, major arms manufacturing countries have in place various laws and regulations. The US, for instance, has three laws – Buy American Act, the Berry Amendment, and the Speciality Metal Restriction – that allow only US-based companies to bid for defence contracts. India could adopt this principle in its Defence Production Policy. At the beginning, the principle could be applied to a list of pre-identified items in which the Indian industry has some expertise.

Various committees constituted by MoD have suggested corporatisation of the Ordnance Factory Board (OFB) to enable it to function under its own Board of Directors and be accountable for its performance. Corporatisation of the OFB would also be the first step for its public listing to further enhance its functioning/accountability.

The decision of the Cabinet Committee on Economic Affairs (CCEA) pertaining to strategic disinvestment of BEML may be taken to its logical conclusion, thus enabling MoD to focus on strategically important production entities.

The three unlisted DPSUs – Goa Shipyard Ltd (GSL), Hindustan Shipyard Ltd (HSL) and Mazagon Dock Shipbuilders Ltd (MDL) – may be listed in the stock market to enhance their corporate governance and public accountability. The disinvestment proceeds may be kept in a separate pool and channelled to build defence industrial and R&D infrastructure.

The four defence shipyards – MDL, GSL, HSL and Garden Reach Shipbuilders and Engineers Ltd (GRSE) – may be consolidated into one or two large corporations so as to enable them to better leverage their combined strength to compete in both domestic and foreign markets

Except for Hindustan Aeronautics Ltd (HAL) and Bharat Electronics Ltd (BEL), no other DPSU or OFB spends any meaningful amount on R&D. This is one of the reasons why they are dependent on others (Defence Research and Development Organisation (DRDO) and foreign suppliers) for technology assistance for production purposes. DPSUs and OFB may be mandated to spend a minimum of 5-7 per cent of their respective turnovers on R&D.

The SP guidelines, announced as part of DPP-2016, is by far the biggest policy measure to enable the private sector to manufacture big-ticket defence equipment, initially grouped under four categories: fighter aircraft, helicopters, submarines, and tanks. The successful implementation of these guidelines will go a long way in establishing the private sector as a force to reckon with. MoD may like to set a timeline for execution of each of the identified projects.

Private companies have come a long way since 2001 when the defence sector was opened up for the first time. Since then, they have committed huge investments in the sector, even though very few worthwhile contracts have come their way. Many big contracts have taken inordinately long to fructify. Time bound execution of these orders will be key to keep the private sector engaged in defence production

Though DPSUs, OFB and DRDO together have nearly 171,000 personnel on their payroll, there is not a single defence-specific educational institution from which to recruit high-skilled staff. In comparison, the Indian Space Research Organisation (ISRO), which has a sanctioned strength of 18,074 (less than DRDO’s existing strength of 24,029), has set up Asia’s first space university, the Indian Institute of Space Science and Technology (IIST), to meet the demands of the space programme. The university offers undergraduate, postgraduate, doctoral and post-doctoral programmes in disciplines relevant to the organisation, and successful students are absorbed in ISRO’s various centres. Taking a cue from ISRO, MoD may like to set up a dedicated Indian Institute of Defence Science and Technology (IIDST) to cater for all the disciplines related to defence technology

As of 2017-18, DRDO has 324 ongoing projects, including 11 major programmes approved by the CCS. These projects, sanctioned at an estimated cost Rs 71, 265 crore, are critical for not only the modernisation of the armed forces but also for self-reliance and Make in India. Most of these projects are scheduled to be completed in a few years of time. However, past experience shows that time and cost overruns as well as performance shortfalls are often a common feature of many a DRDO programme. To prevent ongoing projects from suffering from a similar fate, MoD may like to closely supervise the progress of major projects and address hurdles, if any, in the development phase.

Though the DPP has had an offset provision since 2005, it does not seem to have yielded much dividend since much of the offsets received by Indian industry are in the form of low-value outsourcing work. Considering that offsets come with a hidden cost, MoD may like to tweak its policy to facilitate technology transfer and high-value manufacturing to Indian industry, which would prove beneficial in the long-run

Even though defence production has been growing at a hefty pace, the reliance on imported parts, components and raw materials has remained high. Such imports, which can be termed as indirect arms imports, amount to nearly 60 per cent of the total production of DPSUs and OFB, as per some conservative estimates. Such a high import dependency does not augur well for Make in India and self-reliance. The MoD may like to identify the causes of such high import dependency and devise a suitable strategy to contain it

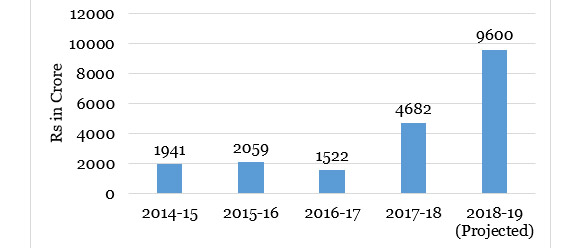

Defence exports have been one of the major success stories of Make in India. It is also indicative of the fact that a strong political and bureaucratic will could serve as a catalytic factor in changing the status quo. Within a few years, the exports of DPSUs and OFB, which are the main pillars of India’s defence production, have increased nearly five times from less than Rs 2,000 crore in 2014-15 to about Rs 10,000 crore in 2018-19 (see Figure). This spectacular growth notwithstanding, there is further scope to boost defence exports, considering that India has the potential to export a range of defence equipment including artillery gun systems, missile systems, armoured vehicles, communication and surveillance systems, bridging systems and military vehicles, among others. The SOP that MoD has recently prepared to provide cheap Lines of Credit may be aggressively pursued to boost defence exports to friendly foreign countries. Further, Defence Attaches posted in various missions may be specifically tasked to promote exports

Source: Department of Defence Production, Ministry of Defence, “Make in India: Armed for a Secure Future”, p. 39.

Indian companies winning defence contracts under the Buy (Global) category may be accorded deemed exports status, since they substitute direct import which would have taken place if the contract had been won by a foreign supplier. Deemed export status would enhance the competitiveness of Indian industry vis-à-vis foreign suppliers as the former would enjoy certain tax-related benefits

Indian companies investing in defence capital assets may also be given 'Infrastructure’ status. The status, which comes with some tax benefits, will make defence investment more attractive in comparison to investment in other sectors that do not enjoy the same status.

Conclusion

Given its volatile security environment and the changing character of warfare, India can least afford to lower its military guard. The last five years have witnessed an unprecedented number of reforms to enhance defence preparedness and equip the armed forces with indigenously sourced arms. With the Modi government returning to office again, these reforms need to be deepened so as to meet India’s security threats effectively and through arms made in India.

The Defence Planning Committee (DPC), which was set up in 2018 to facilitate comprehensive and integrated planning, may go the whole hog and articulate the national security strategy and a set of holistic capability, R&D and manufacturing plan documents. This will not only bridge the historical shortcoming in the planning mechanism, but will also lead to cost-effectiveness in defence capability build-up by eliminating the duplications of efforts and promoting self-reliance. The DPC’s tasks, however, need to be complemented by rationalising the current manpower-driven defence expenditure, making the acquisition apparatus more accountable and professional, and further strengthening the defence manufacturing base to meet the requirements of the armed forces.

Views expressed are of the author and do not necessarily reflect the views of the IDSA or of the Government of India.

| Attachment | Size |

|---|---|

| 345.02 KB |